Who is Walter Shields

I'm Walter Shields, and I've spent 20+ years inside companies, rolling up my sleeves and solving real problems with data.

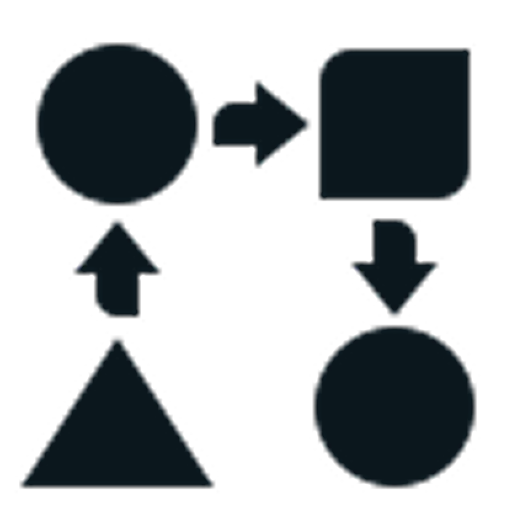

Over the years I realized there's a big gap between how data analysis is taught and how analysts actually work. That's why since 2012 I focused on teaching analytical thinking the way we really solve problems at work. Today, I share my knowledge and experience while showing you how to use AI as our thinking partner.

My courses on LinkedIn Learning have reached over 526,000 professionals around the world. And my courses have an average rating of 4.7. But I'm most proud of the feedback I get from students.